Warren Buffett is very selective about the companies he invests in. That’s why investors should be careful if he continues to invest for decades, even after the company’s value has grown significantly. One of Buffett’s best stock picks is on sale right now. And so far, Buffett hasn’t sold a single stock.

This is the perfect Buffett business

Buffett considers a variety of factors when deciding whether to invest in a particular business. One of the most important is what economists call the economic moat. An economic moat is the type of competitive advantage that can be sustained for years, if not decades at a time.

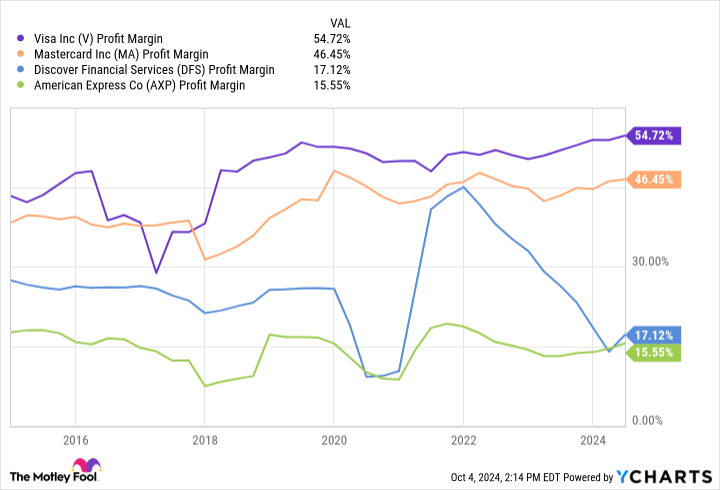

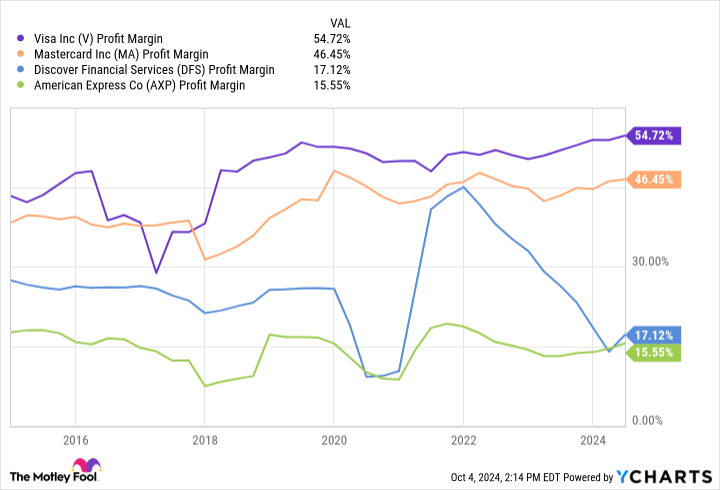

When it comes to a strong economic moat, few companies can match its power. visa (New York Stock Exchange: V). Let’s take a look at its market share numbers. By most metrics, Visa controls at least half of the U.S. credit card market. Only 3 companies — discover financial services, master cardand american express — control the rest. Suffice it to say, this is a highly consolidated market controlled by a small number of strong competitors, with Visa being by far the largest.

Merchants want to accept payment methods that consumers can pay with. And consumers only want to carry payment methods accepted by merchants. It is this dynamic that has driven the consolidation of the U.S. payments industry, and this dynamic will only strengthen over time. That’s because Visa’s dominant market share provides two important benefits.

First, the company’s network generates more data than its competitors combined, considering that more than half of credit transactions occur on the network. Second, Visa’s business model is asset-light, so profitability increases as it scales up. As its biggest competitor, Visa can generate profits that its competitors cannot match. Over the past decade, Visa has outperformed its competitors in terms of profitability, posting a profit margin of nearly 55% last quarter.

With a strong market position supported by natural industry consolidation and economies of scale, Visa has amassed an economic moat that most companies can only dream of.

Is it too late to buy Visa stock?

Buffett first bought Visa stock in 2011 at a price of about $40 per share. More than a decade later, the stock is trading above $270. Is it too late to join? Absolutely not. The stock trades at just 29 times earnings. S&P500 The entire index is traded at. In short, you can buy Buffett’s stock for the long term with incredible economic moat and profitability. zero Comparison of premium and overall market.

Just know that it’s not all roses. Last month, the U.S. Department of Justice announced an investigation into the company for anticompetitive conduct. According to Politico, “The department accused Visa of an extensive scheme dating back to 2012 that artificially inflated the prices payments companies charged merchants and cut off competition from emerging financial technology companies.” .

This is not the first time Visa has been targeted by regulators. Several lawsuits have been filed over the past few decades, but none of them have been able to knock the company out of its position, although fines have temporarily hurt its results. So far, Buffett seems unfazed and his position has not changed since the news broke. The stock has macro risks, but at a P/E ratio of 29x, it’s hard not to follow Buffett into this proven blue chip winner.

Don’t miss out on this potentially lucrative second chance

Have you ever felt like you missed out on buying the most successful stocks? Then you’ll want to hear this.

In rare cases, our team of expert analysts “Double Down” stock Recommendations for companies that are likely to take off. If you’re already worried that you’re missing out on an investment opportunity, now is the best time to buy before it’s too late. And the numbers speak for themselves.

-

Amazon: If you invested $1,000 when it doubled in 2010; you have $21,006!*

-

apple: If you invested $1,000 when it doubled in 2008; There will be $42,905!*

-

Netflix: If you invested $1,000 when it doubled in 2004; you have $388,128!*

We currently have “double down” alerts on three great companies, and we may not see an opportunity like this again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor will return as of October 7, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Discover Financial Services is an advertising partner of The Motley Fool’s Ascent. Ryan Vanzo has no position in any stocks mentioned. The Motley Fool has positions in and recommends Mastercard and Visa. The Motley Fool recommends Discover Financial Services and recommends the following options: A long January 2025 $370 call on Mastercard and a short January 2025 $380 call on Mastercard. The Motley Fool has a disclosure policy.

“Best Buffett Stocks to Invest $500 Now” was originally published by The Motley Fool.

#Buffett #Stocks #Invest