Amid tight supply and strong demand.

Written by Wolf Richter of Wolf Street.

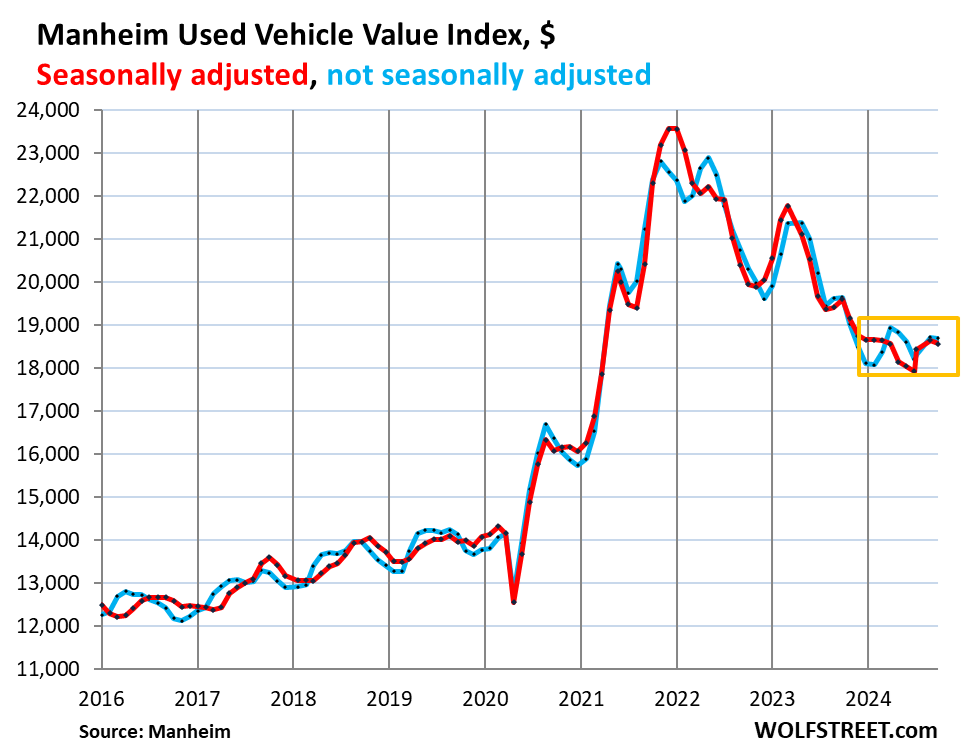

Prices of used cars sold at auctions across the United States barely fell in September after rising for two consecutive months.

According to the Mannheim Used Car Value Index, non-seasonally adjusted wholesale prices fell an average of $26, or 0.1%, to $18,693 per vehicle in September, after rising a combined $513 in the previous two months. . It adjusts as your mix and mileage change (blue in the graph below).

Wholesale prices usually fall in September, but this September the decline was smaller than in a typical September. For example, in 2019, before the price frenzy began, wholesale prices fell by 0.7% in September compared to August, but this September they fell by 0.1%.

“The new normal will likely continue to be an overall decline, but it could be milder than the market is accustomed to for the rest of the year,” Mannheim said. Approximately 8 million vehicles pass through auction lanes each year.

Compared to the same period last year, prices fell by 4.9%. This compares to double-digit declines in the first five months of 2024 as part of a historic price plunge.

Wholesale prices are now down nearly 50% of their pandemic-induced spikes, which seems about right for car buyers.

Seasonally adjusted wholesale prices averaged $89 per unit, or 0.5% lower than August, to $18,565 in September, after increasing by a combined $720 in the previous two months. Seasonally adjusted prices fell by 1.0% in September 2019, double the rate of decline in September of this year.

The drop in September is smaller than usual. And two consecutive months of significant price increases indicate used car wholesale prices are stabilizing, signaling a possible end to the historic selloff, with wholesale prices trailing by several months. Retail prices are likely to decline in the future. Contributed significantly to lowering CPI inflation.

Dealers purchase used cars at these auctions to replenish their inventory. Supply will come from rental fleets selling parts of out-of-service vehicles, finance companies selling unleased vehicles and repositories, corporate and government fleets, and other dealers.

Manheim said the three-year index fell 1.6% in the past four weeks, which is lower than the 1.8% decline in the same four-week period over the five-year period from 2014 to 2019, which was typical for this period before the pandemic. It was said to be small. A division of Cox Automotive.

Supply in the three-year fall segment is constrained by a declining influx of off-lease vehicles whose three-year leases are expiring. Leasing activity plummeted from 2021 to 2023 due to a shortage of new cars and uncertainty about end-of-lease values due to the abnormally high prices of used cars at the time. The sharp decline in leasing activity over the past few years has now led to a sharp decline in lease maturities and a sharp decline in supply to the 3-year-old segment going through auction. This will continue until 2025-2026.

According to Manheim, the average daily sales conversion rate in September was 60.3%, which was higher than normal for September. The same scenario played out in previous months amid strong demand from dealers looking to replenish their used car inventories. And the supply of used cars is tight. According to Manheim, the average conversion rate in September over the past three years was 53%.

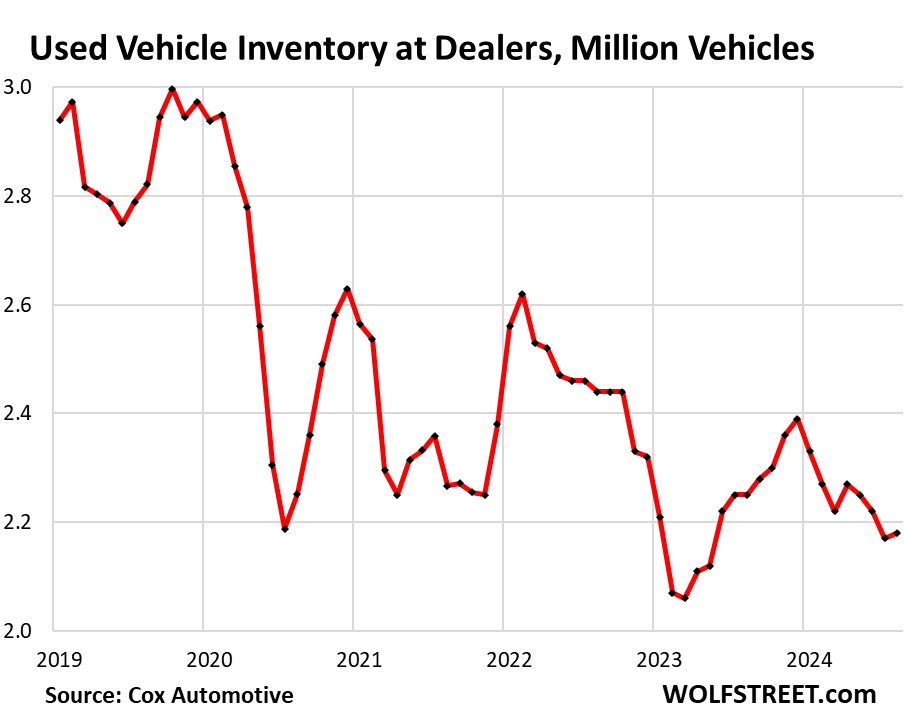

Used car retail inventory remains tight.

Used car retail inventory was about 2.18 million vehicles in early September, down from 2.8 million to 3 million vehicles before the pandemic, according to a separate report from Cox Automotive.

The very basic problem with used car supply from 2024 to 2026 is that new car production fell in 2021 and 2022 due to semiconductor shortages.

Over seven quarters, from the second quarter of 2021 to the first quarter of 2023, when the chip shortage hit auto production and sales, automakers sold 6 million fewer new cars compared to the seven quarters before the pandemic. . These 6 million unmanufactured vehicles cannot be supplied to the used car market. And the problem of 6 million missing vehicles won’t disappear overnight.

However, according to preliminary figures from Cox Automotive, used car retail sales in September increased by 9% compared to the same month last year based on the number of units sold. As supplies tighten, dealers are buying at auction to replenish retail inventories. This appears to be putting an end to the historic decline in used car prices.

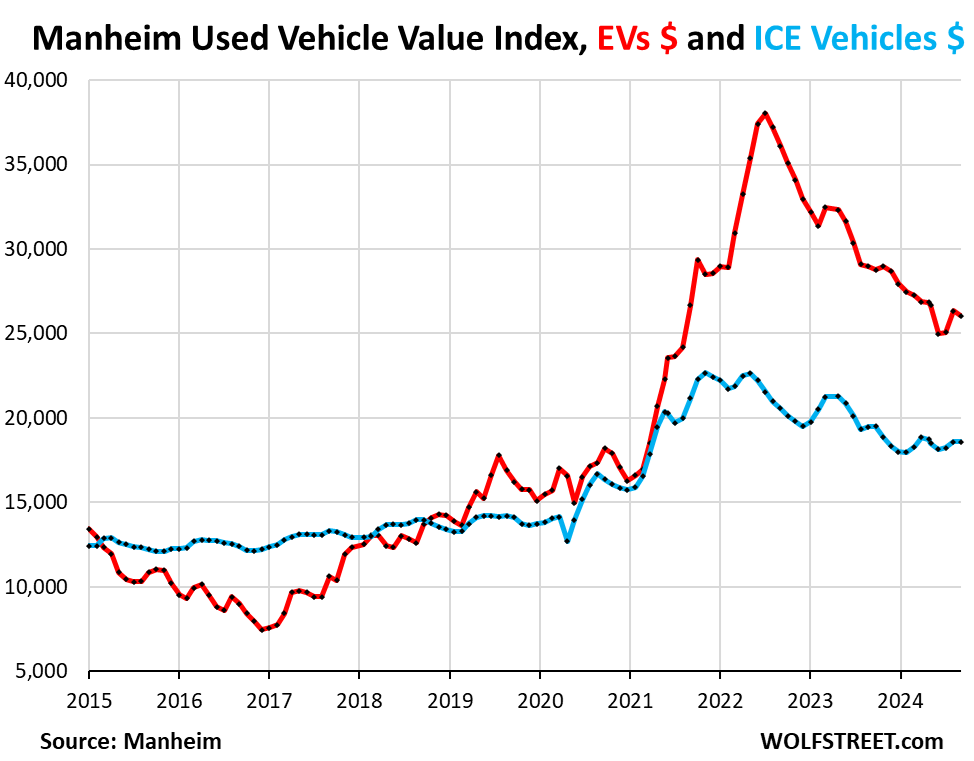

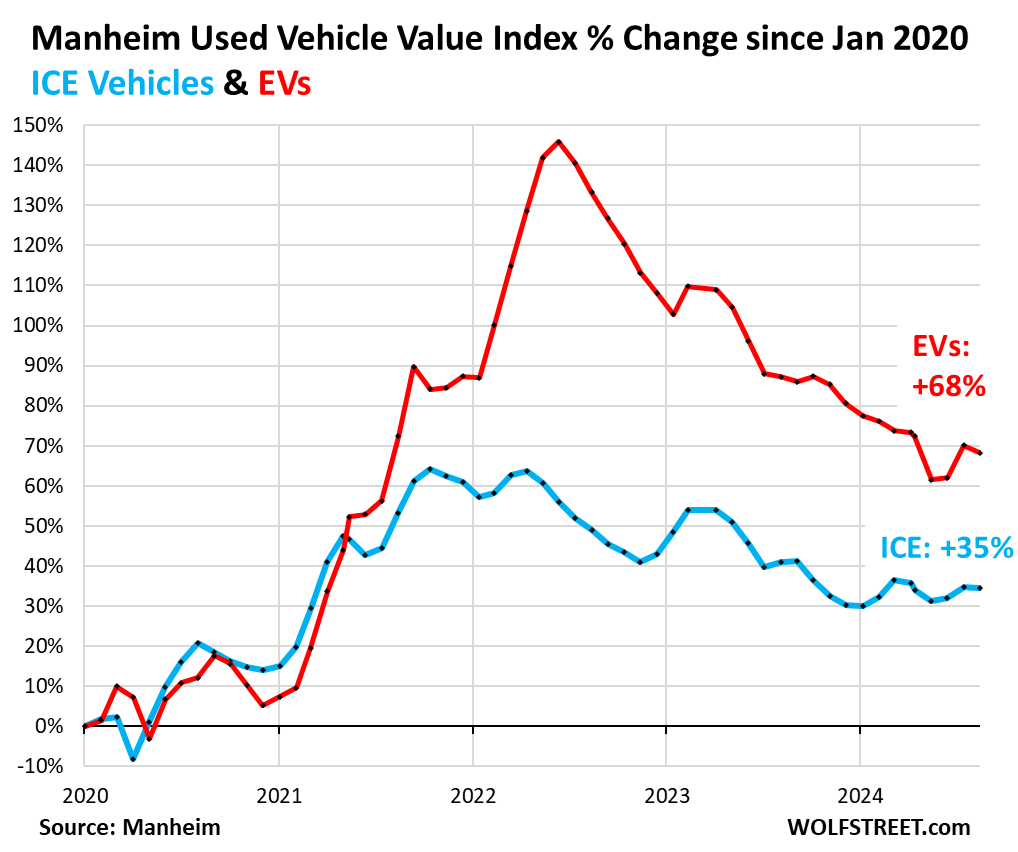

Prices of used EV and ICE vehicles.

Wholesale EV prices fell 1.1% in September after surging 5.1% in August from July (red in chart below, no seasonally adjusted).

ICE vehicle prices fell 0.1% in September (blue, not seasonally adjusted) after increasing 2.0% in August from July.

From January 2020, when Tesla’s reversal became a hot topic, to July 2022, the price of used EVs soared by 145%. Tesla has largely prevented Tesla’s reversal by ramping up production and lowering prices starting in 2022.

From January 2020 to July 2022, ICE used car prices increased by less than half that amount, a still staggering 64%.

EV gave up about 53% of the 145% surge. ICE vehicles abandoned 46% of the 64% spike. As such, EV prices remain much higher in relation to ICE vehicle prices than they were before the pandemic, and are still far out of sync with ICE vehicle prices.

Since January 2020, wholesale prices for EVs are still up 68%. ICE vehicle prices have increased by 35%.

Wholesale prices for the most popular segments:

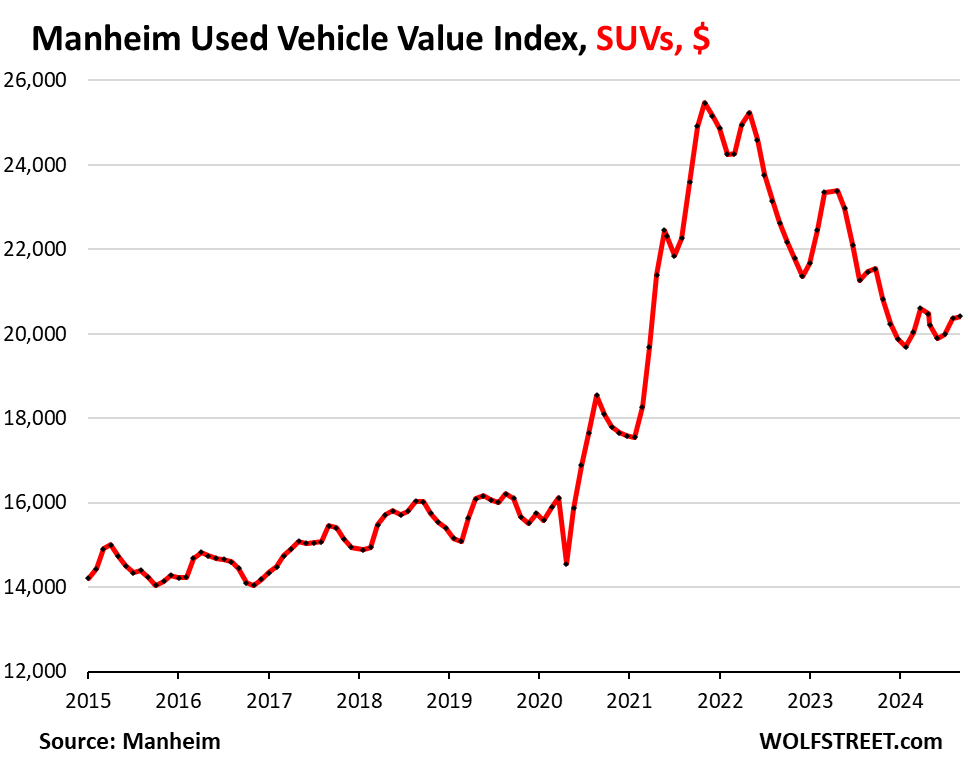

SUV prices rise. The total winning bid price for all types of SUVs, from compacts to full-size SUVs, rose 0.2% from August in September to $20,411, the third consecutive month of increases, and was down 5.2% year-on-year. 49% increase in pandemic surge:

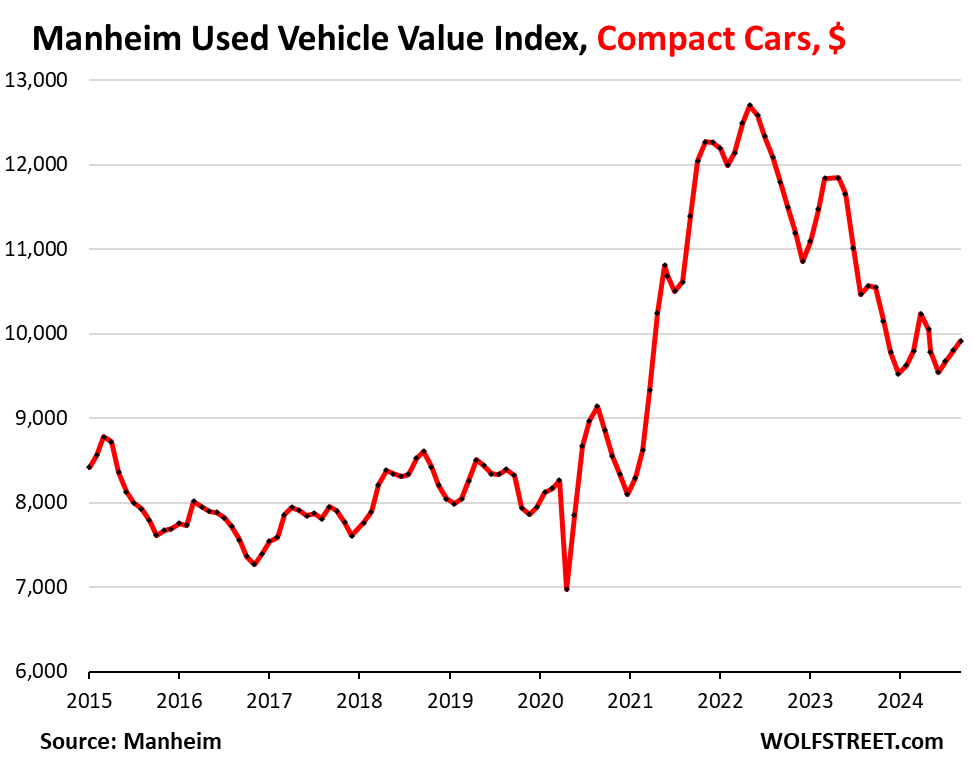

Compact car prices rise: Auction prices for compact cars rose 1.1% from August to $9,915 in September, the third straight month of increases. It fell 6.0% year-on-year, giving up 61% of the pandemic-induced rally.

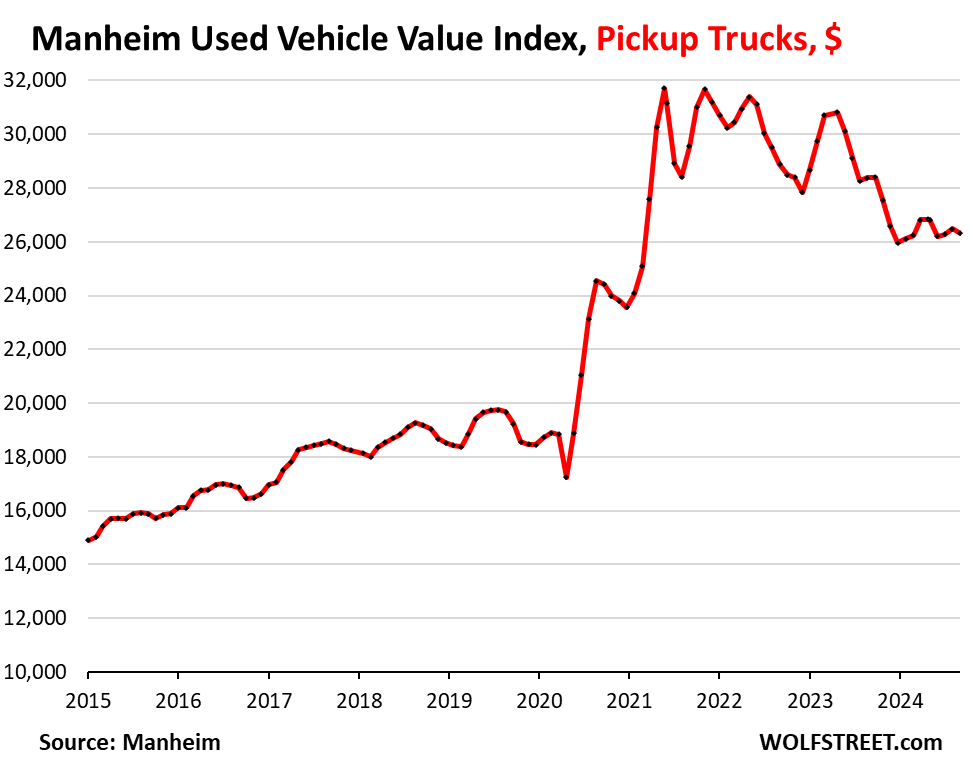

Pickup truck prices fall Prices fell 0.6% from August to $26,235 in September, and are down 7.3% from a year ago, giving up 40% of the pandemic-induced surge.

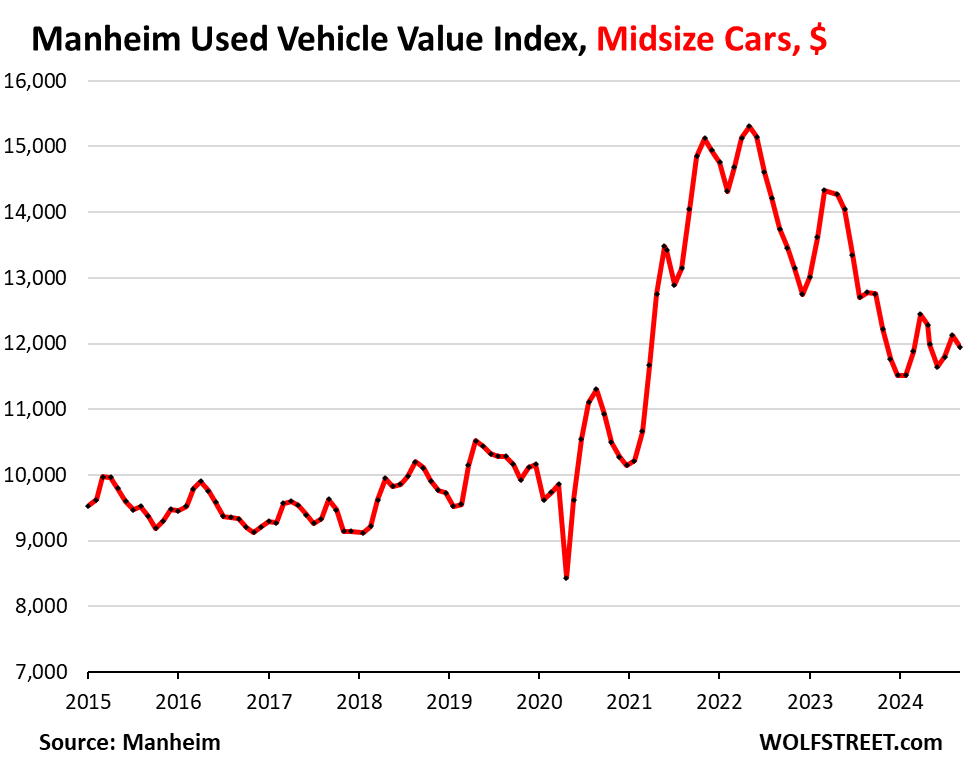

Mid-size car prices fall September was up 1.5% from August to $11,946, down 6.3% from a year ago and giving up 59% of the pandemic-induced surge.

Enjoy reading and supporting Wolf Street? You can donate. I am very grateful. Click on the beer and iced tea mugs to see how.

Would you like to receive email notifications when new articles are published on WOLFSTREET? Sign up here.

![]()

#evidence #historic #collapse #car #prices #depressed #CPI #coming